Your Credit after Bankruptcy

Credit after bankruptcy depends on what you do to rebuild it after bankruptcy. If you have a proven program to guide you through the steps you need to take, telling you what to do, how to do it, and when to do it, you can recover your credit amazingly fast.

How Fast Can You Recover Credit After Bankruptcy?

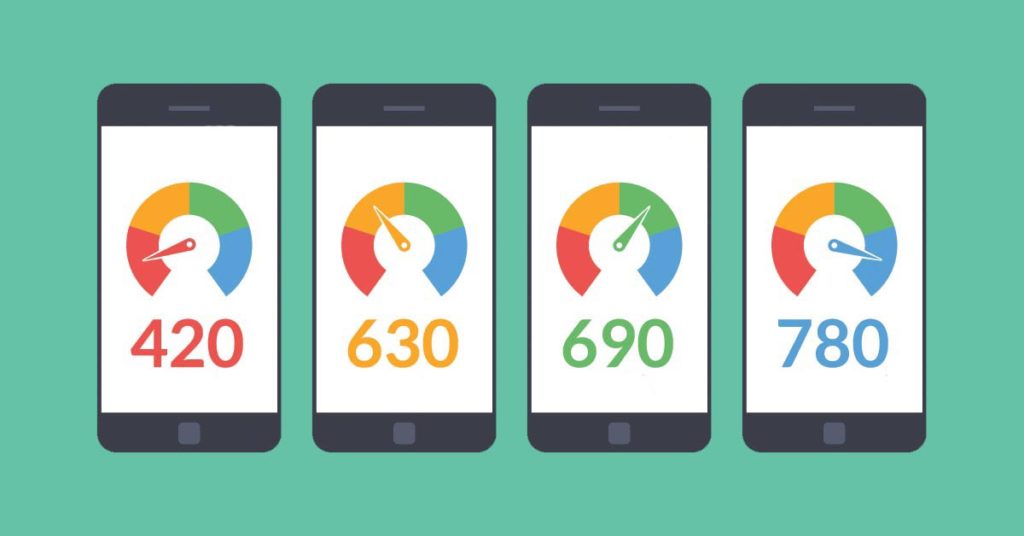

My clients typically get credit scores of 650 – 700 within one year of their chapter 7 discharge with my credit recovery program. This is a true FICO score, not the Vantage score you get on Credit Karma and other “free credit score” websites. My chapter 13 clients usually achieve these scores even before they have completed their plan.

So why does everyone believe that bankruptcy hurts your credit? Because it often does work that way. Why? Because almost nobody who files bankruptcy knows what to do after their case is over to rebuild their credit score. But there is a way to rapidly recover credit after discharging your debt in bankruptcy. And, it’s not hard to do. I teach my clients how to get good credit after discharging their debts in bankruptcy.

Here’s the Secret to Recover Credit After Bankruptcy

Other bankruptcy attorneys just practice bankruptcy law. They are not certified credit counselors like I am. They have not been taught how to help their clients with their credit. That’s not part of bankruptcy law. It’s credit recovery, and it’s not taught in law school.

Because other bankruptcy attorneys are not trained in credit recovery and credit report analysis, they don’t offer their clients assistance in this critical part of financial recovery. I’ve spoken to a number of people who have been represented by and had consultations with other attorneys. Without exception, they tell me that no attorney they spoke with offered any help or guidance to rebuild their credit or teach them how to read their credit report.

If you are to finish the job that bankruptcy starts, you MUST have a proven program that shows you, step by step, how to do all three of these steps:

- How to Rebuild Your Credit

- How to Review Your Credit Report to Spot Errors that Hurt Your Score

- How to Effectively Dispute Errors Once You Spot Them

Legal Services

Quick Reference

Get Your Free Consultation And Review All Your Options

Start the bankruptcy recovery process now with a free consultation after completing our online evaluation form.

Useful Calculators

Here are two helpful calculators for managing your debt repayments and Chapter 13 commitments.

How to Rebuild Credit After Bankruptcy

The first step involves obtaining new credit. There is definitely a right way and several wrong ways to do this. Timing is everything. Also, knowing “good credit” from “bad credit” is essential. Over the last 20 years, I’ve tried and tested many different approaches to getting credit after bankruptcy and have found several very safe and effective ways to establish new credit without risking getting back into debt.

The next step is to learn how to quickly and easily review your credit report for errors that hurt your score. Most people report to me that they really don’t understand their credit report. They look at their score, but don’t understand the information in the report. It just looks like a bunch of numbers, they tell me. Don’t worry, it’s not hard. With a little help, this becomes a simple task.

It’s important to know what to look at and what to ignore. It is very common to spot errors on credit reports. But not all errors affect your score. Some do, some don’t. You only need to be concerned about the ones that can lower your score. (Some errors actually help your score!) My course teaches you how to spot errors that need to be corrected. This leads to the next step.

Finally, you need to know how to dispute errors that lower your score. Knowing this turns a seemingly overwhelming task into one that is simple and manageable. My credit recovery course teaches you the mistakes the credit bureaus try to get you to make in this process which can cause you to lose valuable legal rights you might need later.

Is it Possible to Get Good Credit After Bankruptcy?

Absolutely! And, it doesn’t need to take very long. Here are just a few comments from clients who have take my credit recovery course:

Paul W.

Phil C.

Vincent D.

Brandon B.

Who just finished his chapter 13 a few months ago, called in to report that he and his wife have scores over 700. They just got a new car loan with Wright Patt under 4%. The bankruptcy and the credit recovery course has been a god-send.

These are just a few of our clients who “finished the job that bankruptcy started” and got good credit. With the program we provide, they will continue to monitor their credit, and ensure that their scores are always as high as they can be, because they know how to easily spot errors that hurt their score and effectively dispute them.

Ready? Get on the Road to Bankruptcy Recovery

We are still open for remote filing and remote consultations during the pandemic. All consultations are free and there is no catch. We only work with clients who want to work with us. Nothing high-pressure. We look forward to assisting you.