Finding a Financial Second Chance

Need a Fresh Start? Life doesn’t always go according to plan. Unexpected medical bills, job loss, divorce, or overwhelming debt can leave even the most responsible individuals feeling trapped and hopeless. But here’s the truth: financial setbacks don’t define you. They can be the very start of something better. More than a quarter of US […]

Debunking Debt Myths

What Are The Myths Surrounding Debt? Debt is dangerous. Never borrow money. Paying interest is throwing money away. Sound familiar? These are just a few of the debt myths that circulate like gospel, repeated so often that many people accept them without question. But here’s the truth: not everything you’ve heard about debt is accurate. […]

The Truth About Trump’s Bankruptcies

Trump Bankruptcies and The Reality When people hear the word “bankruptcy,” it often evokes images of financial failure and ruin. So when it comes to someone as high-profile as Donald J. Trump, a real estate mogul turned U.S. President, the word takes on even greater significance. Critics frequently point to Trump’s multiple corporate bankruptcies as […]

When Creditors Violate an Automatic Stay

Automatic Stay Violations Filing for bankruptcy is often a difficult but necessary step for individuals or businesses overwhelmed by debt. It offers a legal pathway to regain control of finances and start fresh. One of the most immediate and powerful protections it provides is the automatic stay, a court-ordered shield that halts all collection efforts […]

Does Medical Debt Affect Your Credit Score?

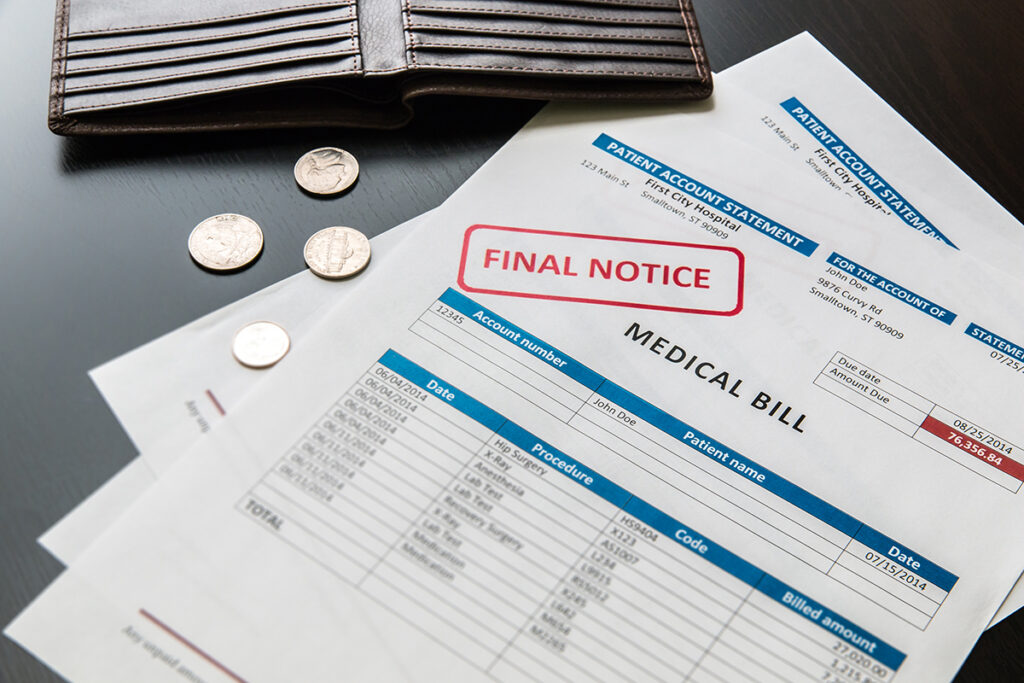

Impact of Medical Debt on Your Credit Score Medical debt is a common financial burden that many individuals face, but does it have an impact on your credit score? Approximately 14 million people (6% of adults) in the U.S. owe over $1,000 in medical debt, and about 3 million people (1% of adults) owe medical […]

What to Do About Collections Harassment in Ohio

Ohio Collections Harassment Getting endless calls from debt collectors can be overwhelming and stressful. It’s not just about the debt, but about feeling trapped and losing your peace of mind. No one should have to deal with threats or bullying over unpaid bills. If you’re facing relentless debt collection tactics in Ohio, knowing you have […]

What Should I Bring to My Ohio Bankruptcy Appointment?

What to Bring When Meeting an Ohio Bankruptcy Lawyer Declaring bankruptcy helps people or businesses that cannot pay their debts find a way to fix their money problems. It can also help them get a fresh start and improve their finances over time. Bankruptcy requires a significant amount of paperwork because the court determines whether […]

Top 5 Tips For a Successful Ohio Bankruptcy Filing

Filing Bankruptcy in Ohio Bankruptcy can be a lifeline for those overwhelmed by financial difficulties, offering a chance to clean the slate and rebuild from the ground up. Whether it’s mounting medical bills, job loss, or an unexpected economic setback, bankruptcy provides legal protection and a structured path to address your debts. Far from being […]

What Went Wrong with 23andMe?

What is 23andMe Known For? Founded in 2006, 23andMe emerged as a trailblazer in consumer genomics, allowing everyday people to access insights about their ancestry and potential health risks through simple at-home DNA tests. The company’s breakthrough came with its direct-to-consumer model, which made genetic testing more accessible and affordable compared to traditional methods. By […]

The Ohio Exemption Increases

Ohio Exemption Increases in April 2025 In Ohio, legal exemptions are provisions that allow individuals to protect certain assets from being seized by creditors during legal proceedings such as bankruptcy, garnishment, or attachment. These exemptions are designed to ensure that debtors can retain essential property necessary for their well-being and livelihood, even in the face […]