Bankruptcy Blog

- All

- Attorney Quesions

- Attorney Questions

- Bankruptcy

- Bankruptcy Attorney Questions

- Bankruptcy Filling

- Chapter 13

- Chapter 7

- Collections Harassment

- Coronavirus

- COVID-19

- Credit

- Creditors

- Debt

- DIY

- Eviction

- Exemptions

- Foreclosure

- Keeping Property

- Medical Bills

- News

- Ohio Bankruptcy News

- Statistics

- Student Loans

- Utilities

- Wage Garnishment

All

- All

- Attorney Quesions

- Attorney Questions

- Bankruptcy

- Bankruptcy Attorney Questions

- Bankruptcy Filling

- Chapter 13

- Chapter 7

- Collections Harassment

- Coronavirus

- COVID-19

- Credit

- Creditors

- Debt

- DIY

- Eviction

- Exemptions

- Foreclosure

- Keeping Property

- Medical Bills

- News

- Ohio Bankruptcy News

- Statistics

- Student Loans

- Utilities

- Wage Garnishment

Finding a Financial Second Chance

July 1, 2025

No Comments

Need a Fresh Start? Life doesn’t always go according to plan. Unexpected medical bills, job loss, divorce, or overwhelming debt can leave even the most ...

Read More →

Debunking Debt Myths

June 21, 2025

No Comments

What Are The Myths Surrounding Debt? Debt is dangerous. Never borrow money. Paying interest is throwing money away. Sound familiar? These are just a few ...

Read More →

The Truth About Trump’s Bankruptcies

June 14, 2025

No Comments

Trump Bankruptcies and The Reality When people hear the word “bankruptcy,” it often evokes images of financial failure and ruin. So when it comes to ...

Read More →

When Creditors Violate an Automatic Stay

June 7, 2025

No Comments

Automatic Stay Violations Filing for bankruptcy is often a difficult but necessary step for individuals or businesses overwhelmed by debt. It offers a legal pathway ...

Read More →

Does Medical Debt Affect Your Credit Score?

June 7, 2025

No Comments

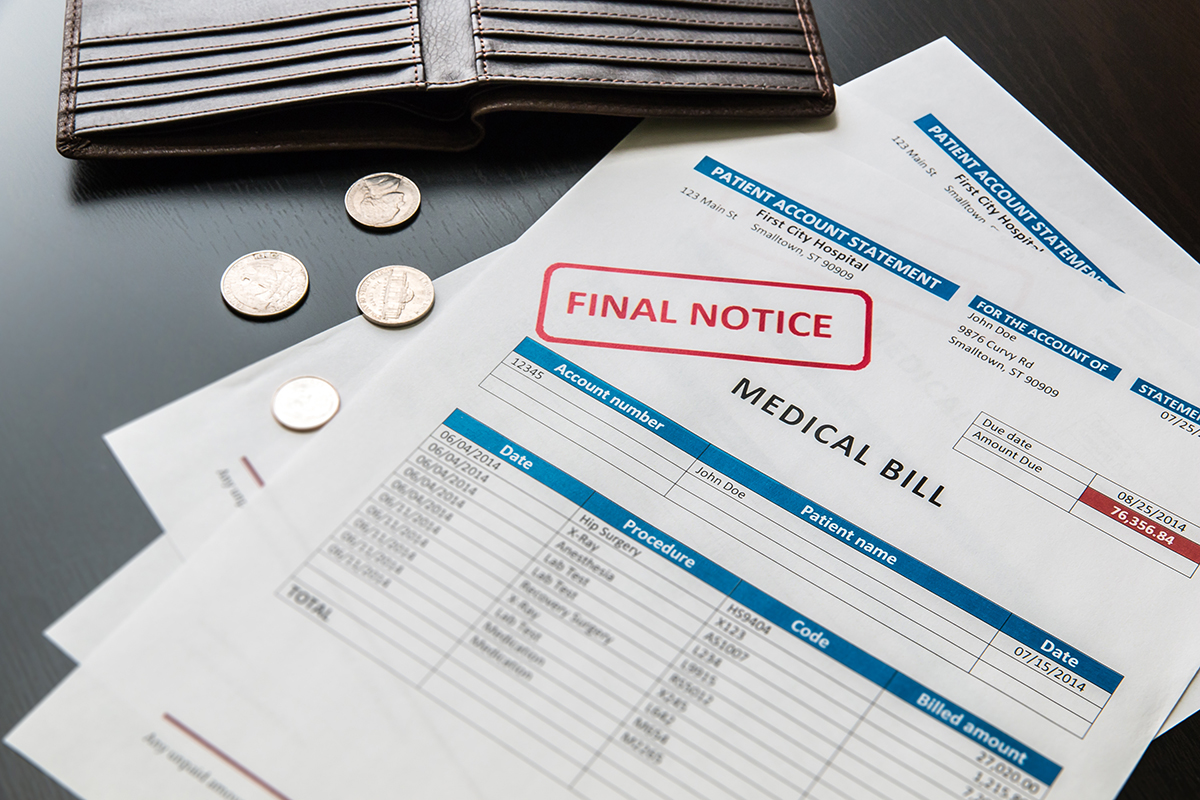

Impact of Medical Debt on Your Credit Score Medical debt is a common financial burden that many individuals face, but does it have an impact ...

Read More →

Bankruptcy Blog

- Attorney Quesions (1)

- Attorney Questions (3)

- Bankruptcy (36)

- Bankruptcy Attorney Questions (2)

- Bankruptcy Filling (9)

- Chapter 13 (7)

- Chapter 7 (4)

- Collections Harassment (1)

- Coronavirus (1)

- COVID-19 (4)

- Credit (3)

- Creditors (3)

- Debt (8)

- DIY (1)

- Eviction (1)

- Exemptions (3)

- Foreclosure (8)

- Keeping Property (1)

- Medical Bills (2)

- News (4)

- Ohio Bankruptcy News (2)

- Statistics (2)

- Student Loans (2)

- Utilities (1)

- Wage Garnishment (2)

Get Your Free Consultation And Review All Your Options

Start the bankruptcy recovery process now with a free consultation after completing our online evaluation form.

Useful Calculators

Here are two helpful calculators for managing your debt repayments and Chapter 13 commitments.