Can I File for Chapter 7 Bankruptcy Without My Spouse?

Filing for bankruptcy is a major financial decision, especially when you are married. Among the most common forms of consumer bankruptcy is Chapter 7. This form of bankruptcy enables individuals to discharge most unsecured debts, including credit card debt and medical bills.

A question often arises: “If I’m married, can I file Chapter 7 alone?” The short answer is yes, but the full picture is more complex.

Yes, You Can File Chapter 7 Alone – But Here’s What That Means

The U.S. Bankruptcy Code allows individuals to file for Chapter 7 bankruptcy even if they’re married. This means that one spouse can go through the bankruptcy process without involving the other in the legal filing. In fact, in some cases, filing separately might be the smarter choice, especially if only one spouse is burdened with debt.

However, just because your spouse doesn’t file with you doesn’t mean they’re completely unaffected. Your household income, jointly owned assets, and shared debts can still play a role in your case. The bankruptcy trustee will still require a full picture of your financial situation, including your spouse’s income, to determine eligibility and how your case is handled.

So, while filing alone is possible, it’s necessary to understand how your marriage impacts the process and what to expect going forward.

When Filing Chapter 7 Bankruptcy Alone Makes Sense

Filing Chapter 7 bankruptcy on your own, even while married, can be the right move depending on your specific financial situation.

Here are some common scenarios where it might make sense to file without your spouse:

- Only One Spouse Has Significant Debt:

If the debts are solely in your name like personal credit cards, medical bills, or unsecured loans it may not make sense for your spouse to file jointly. Filing individually helps protect their credit and keeps them out of the legal process. - Your Spouse Has a Strong Credit Score:

If your spouse’s credit is in good shape and they need it to secure a mortgage, car loan, or business financing, filing separately helps preserve that credit history. A joint bankruptcy would impact both of your credit reports. - You Want to Protect Your Spouse’s Assets:

In some cases, assets held solely in your spouse’s name might not be affected by your bankruptcy filing. This can be beneficial if your spouse owns valuable property or investments. - You Keep Finances Largely Separate:

Some married couples maintain separate bank accounts, credit cards, and property. If your finances are not significantly intertwined, a solo filing may be more straightforward and less disruptive. - If You Are Legally Separated or Planning Divorce:

Bankruptcy during a divorce can get complicated. Filing alone before or during separation might allow you to clear debts without affecting your spouse’s future financial obligations.

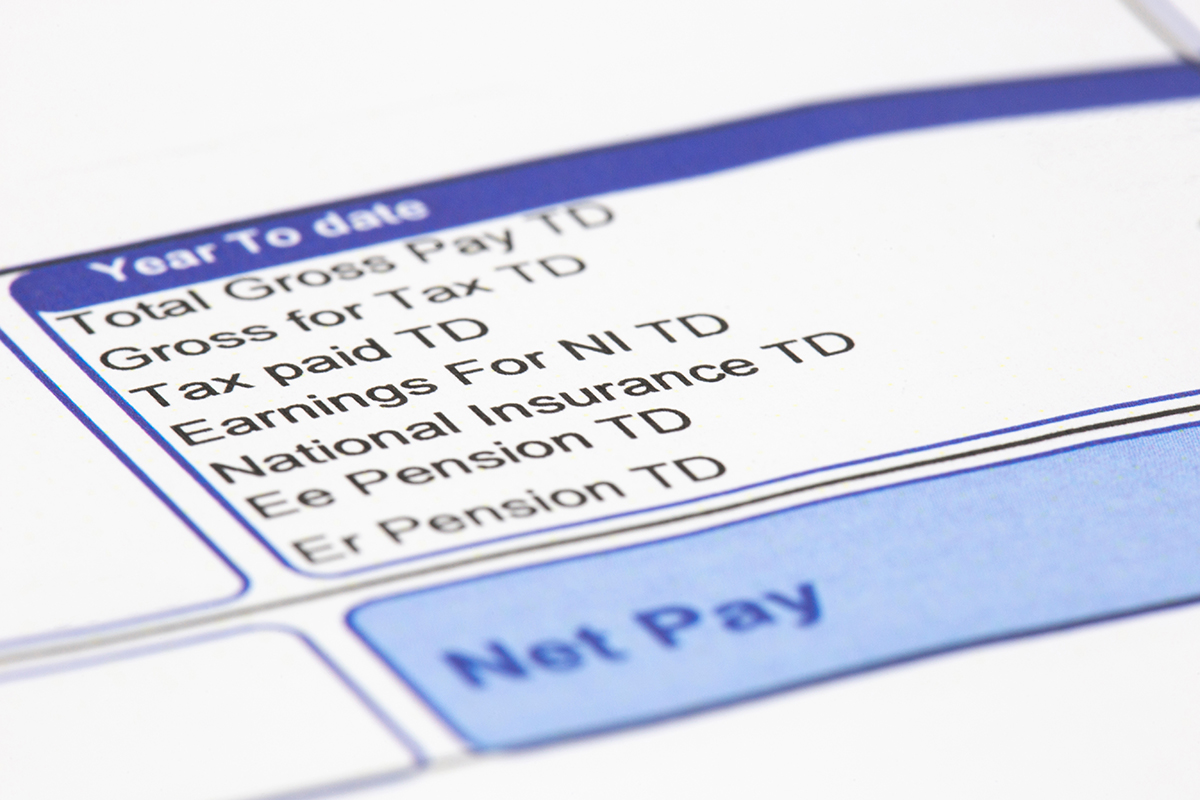

The “Means Test” and Your Household Income

Even if you are filing for Chapter 7 bankruptcy individually, your spouse’s income typically must be included in the Means Test, which determines if you qualify based on your financial situation. This test compares your household’s average income over the past six months to the median income in your state. In January 2025, the estimated median household income in the US was $82,373. [1]

Why Your Spouse’s Income Matters

Although your spouse isn’t filing, their income still counts because the test looks at total household income. This includes wages, self-employment income, and other earnings, even if your spouse isn’t liable for your debts.

The Marital Adjustment Deduction

You may be able to exclude some of your spouse’s income using the marital adjustment deduction, which allows you to subtract income used solely for their personal (non-household) expenses, like separate loan payments or support obligations. [2]

Income Reporting Accuracy Is Key

Accurately reporting both incomes and properly applying deductions is critical. Incorrect information can lead to the denial of your case or even allegations of bankruptcy fraud. Always document income with pay stubs and bank records, and consider speaking with a bankruptcy attorney for guidance.

Protecting Joint Assets Before Filing

When filing Chapter 7 individually, it’s essential to consider how jointly owned assets like homes, cars, or bank accounts could be affected by the bankruptcy process. While bankruptcy laws offer some protections, proper planning is key to minimizing the risk of losing shared property.

Consider Joint Property

Jointly owned assets are typically considered part of the bankruptcy estate, even if your spouse isn’t filing. This includes:

- Jointly titled real estate

- Joint bank accounts

- Vehicles owned together

- Household items acquired during the marriage

A bankruptcy trustee can claim your share of any non-exempt property for the benefit of creditors.

Use Available Exemptions

Every state provides legal protections that allow you to shield certain property from creditors.

Depending on your state’s laws, you may be able to:

- Protect the entire value of a jointly owned home (especially in states recognizing tenancy by the entirety)

- Use wildcard exemptions to protect miscellaneous property

- Double exemption amounts in some joint filings (not available if filing individually in many states)

Consult your state’s exemption rules or a bankruptcy attorney to see what protections apply.

Avoid Transferring Property Before Filing

It may be tempting to transfer joint assets into your spouse’s name before filing, but doing so can be seen as a fraudulent transfer. The bankruptcy court may undo these transfers or penalize you if they appear to be made to hide assets.

Keep Accurate Records

To claim exemptions and prove joint ownership, you’ll need proper documentation such as:

- Titles and deeds

- Bank statements

- Purchase receipts

- Property appraisals

Accurate records will help ensure your assets are treated fairly and legally.

Tips Before Filing Chapter 7 Alone

If you are considering filing Chapter 7 bankruptcy without your spouse, it’s essential to take thoughtful steps before starting the process.

Here are some practical tips to help you prepare and avoid common pitfalls:

1. Gather Comprehensive Financial Information

Even though you’re filing individually, the court still requires a full picture of your household finances, including your spouse’s:

- Income (pay stubs, tax returns)

- Assets (property, bank accounts, retirement funds)

- Expenses (household bills, insurance, childcare)

- Debts (both individual and joint)

Thorough documentation is key to passing the Means Test and accurately completing your bankruptcy forms.

2. Be Transparent and Honest

Omitting information, especially about household income or jointly owned assets can result in dismissal of your case or allegations of fraud. Full transparency ensures smoother proceedings and legal protection.

3. Review All Joint Debts

Make a list of all debts and identify which ones are solely in your name versus joint debts. This will help you assess how much liability might remain with your spouse after the discharge and whether filing jointly would be more beneficial.

4. Consider the Long-Term Impact on Your Marriage

Bankruptcy can relieve financial stress, but it may also create tension if only one partner files. Discuss your plan openly with your spouse and consider how the filing might affect shared goals like home ownership, credit access, or business plans.

5. Consult a Chapter 7 Bankruptcy Attorney

Every situation is different. A qualified Chapter 7 bankruptcy attorney can:

- Help determine whether you qualify for Chapter 7

- Explain how your state’s exemption laws apply to joint property

- Advise whether filing jointly would be more strategic

- Ensure you don’t make costly mistakes before or during filing

Need personalized guidance for your bankruptcy case? Contact Richard West, our Chapter 7 bankruptcy attorney, to explore your best options with confidence.

Frequently Asked Questions (FAQs)

If you are married and considering filing Chapter 7 alone, you’re likely to have a few lingering questions. Here are answers to some of the most common ones:

No. If your spouse is not filing, they typically do not need to appear in court or attend the 341 Meeting of Creditors. However, their financial information may still be required as part of your filing.

Possibly. Even if you’re filing individually, your household income, including your spouse’s, must be disclosed. If your combined income exceeds your state’s median, it could make you ineligible for Chapter 7, unless deductions (like the marital adjustment) bring you under the threshold.

No. Once you file individually, your case cannot be converted into a joint case. If your spouse decides to file later, they would need to start a separate case.

Yes. Jointly owned property may still be included in the bankruptcy estate and could be subject to liquidation, depending on how it’s titled and whether exemptions apply. A trustee may look at your portion of the asset when determining its value to creditors.

Not directly. If your spouse is not a co-debtor or joint account holder, your bankruptcy will not appear on their credit report. However, if they are legally responsible for joint debts, those accounts could be affected if payments lapse.

Sources:

[1] Average US salary by state for 2025 | SOFI. (2025, April 8). SoFi. https://www.sofi.com/learn/content/average-salary-in-us/

[2] O’Neill, C. (2024a, May 24). The marital adjustment deduction on the means test. www.nolo.com. https://www.nolo.com/legal-encyclopedia/marital-adjustment-deduction-bankruptcy-means-test.html