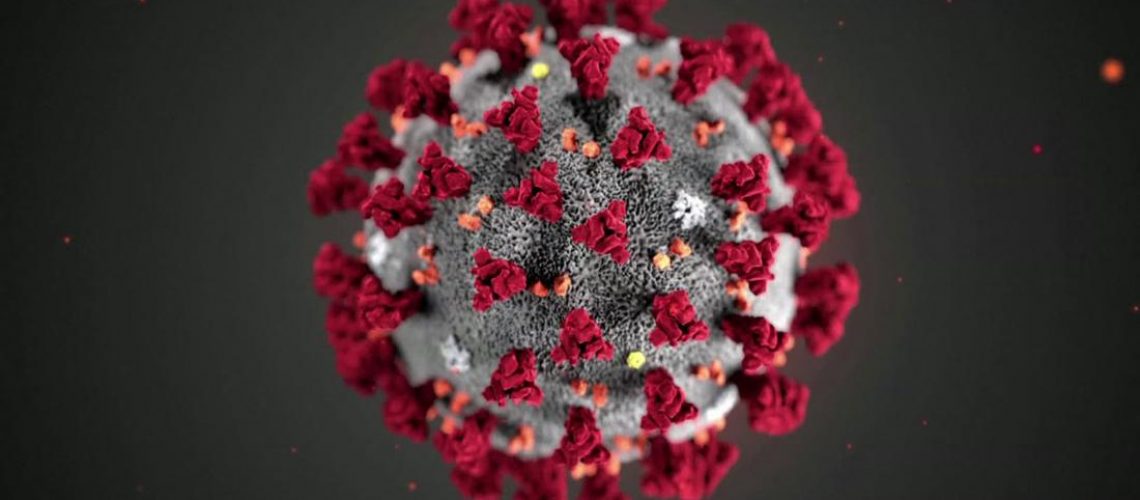

Novel Coronavirus COVID-19

Coronavirus Ohio Bankruptcy

The Coronavirus spread is wreaking havoc on our economy, our nerves and instantly changing our way of life.

The financial disaster we now have is, in one way, no different than the same kind of problem I have helped people overcome for over 30 years.

Serious health issues, loss of employment, financial stress, missing paychecks, are all too familiar problems to me. I’ve had all of them myself, and many at the same time.

But this really IS different, because of the sheer magnitude of the situation.

The record unemployment filings.

The increasing number of new coronavirus cases reported every day.

The growing list of business closing, either because the government is forcing them to close, like bars, restaurants, hair salons, etc, or because the lack of customers.

People are scared to venture out of their homes, and now we have the “stay at home” order, which makes it impossible for many businesses to keep the doors open, even if they want to.

COVID-19 and Personal Bankruptcy

Covid19 and Personal Bankruptcy

None of us have, in our lifetimes, ever faced such a national emergency.

But, we will survive.

And, filing consumer bankruptcy will be major part of the recovery effort.

In the Dayton, Cincinnati and Columbus areas, we have seen major economic loss before, and often affecting large numbers of people, like the GM shutdown.

But this is much, much more.

Most of us live, if not paycheck to paycheck, without enough savings to last for 6 months.

Most of us will need to borrow funds, rely on credit cards, personal loans, and any other means available to make it through this disaster.

When we are threatened by creditor actions, lawsuits, garnishment, repossession and bank account levy, we have to fight back.

There is protection from loss of your property and income.

It’s called the bankruptcy system.

Bankruptcy Courts and COVID–19

The United States Bankruptcy Courts for the Southern District of Ohio are open, although they are not holding “in-person” hearings, they are open and cases continue to be processed. We have an update page on our website with up-to-the-minute information on Court operations. Click on www.debtfreeohio.com/update

Richard West Law Offices are open. We are still meeting with our clients, not in person, though. We are using facetime, Skype, GoToMeeting, Facebook and telephone calls.

Our clients can still drop off paper documents.

We can process your entire case, from our initial telephone consultation with one of our highly experienced attorneys, though the case preparation, signing and filing, and the telephonic trustee meeting. You can actually have your entire case processed without leaving your home.

Many of our trustees are conducting our mandatory 341 trustee meetings by telephone and facetime.

National Emergency Bailout – Stimulus from Government

While the government is going to provide a stimulus package, and help everyone as much as a government can, ultimately WE are responsible for taking care of ourselves, our families. The government checks will not go far enough.

Some of the experts predict massive bankruptcy filings once the virus comes under control, whenever that happens.

However . . .

I am seeing an increase in filings now.

And, I am recommending to my clients that they conserve their cash, focus on family first, prepare for tough times, and do what they have to do to survive.

In other words, it might be a good idea NOT to pay ordinary credit card debt, medical bills, or other unsecured debts, until we have a better idea what the future brings.

Collection Actions are NOT Suspended Due to COVID–19

Debts Will Not be Forgiven Voluntarily

Personal Bankruptcy and Coronavirus