It's Never Too Late To Start Budgeting

Are you finding it difficult to meet your financial needs while also saving for emergencies or future expenses? You’re certainly not alone. Learning to budget is a skill that can significantly transform your financial outlook, regardless of when you start.

Financial literacy empowers you to take charge of your future. Your financial freedom relies on your understanding and development of realistic budgeting skills. Are you among those who have yet to harness the power of budgeting? If so, it’s time to become more conscious of the vital role budgeting plays in your life.

Let’s explore fundamental budgeting techniques, from tracking expenses to applying the 50/30/20 rule, to help you make informed spending decisions. It’s never too late to learn and master the art of budgeting.

How Conscious Are You of the Role Budgeting Serves in Your Life?

Budgeting provides a structured approach to managing your finances and ensuring long-term financial stability. Being conscious of your income and expenses allows you to prioritize your spending, save for future goals, and effectively handle unexpected financial challenges.

By maintaining a budget, you are able to track your financial progress and make informed decisions that align with your personal and financial objectives. It helps you maintain control over your financial situation, reduce stress, and ultimately achieve a sense of security and peace of mind.

Without budgeting, you risk overspending. This can cause you to miss out on opportunities to build wealth and secure your future. Remember, it’s never too late to learn to budget effectively; whether you’re 8 or 80, budgeting can help you face all financial stages of life with confidence.

What is Financial Literacy?

Over the past eight years, about half of Americans had a basic understanding of financial principles, but this financial literacy rate has decreased by 2% over 2023 and 2024. [1]

Financial literacy is the foundation upon which effective budgeting is built. It is the ability to understand and apply a range of financial skills, such as budgeting, investing, and managing your personal finances.

Financial literacy also encompasses knowing how to create an emergency fund, manage student loans, and make the most out of credit cards without falling into high-interest debt. [2]

Setting Financial Goals Enhances Your Budgeting Skills

Setting financial goals is a fundamental step in personal finance and money management. Whether you are looking to pay off credit cards, save for a vacation, or plan for retirement, having clear financial objectives can guide your financial decisions and improve your overall financial wellness.

Goals can be both a source of motivation and a roadmap for achieving a balanced financial life. By establishing clear goals, you lay the groundwork for making informed decisions about credit score improvements, managing debt, and navigating the sometimes complex landscape of interest rates and financial literacy.

Comparing Short-Term and Long-Term Goals

Short-term goals are objectives you aim to achieve in the near future, usually within the next year or so. Examples could include establishing an emergency fund, paying off high-interest loans, or saving for a new gadget.

Long-term goals take more time, generally over five years, and include saving for retirement, paying student loans, or a home down payment. They need disciplined planning and higher risk tolerance. Compound interest can greatly affect your savings.

When establishing your goals, it’s vital to balance both short- and long-term objectives, ensuring that focusing on immediate concerns doesn’t overshadow slowly progressing items like saving for retirement. It allows you to maintain a healthy financial lifestyle while preparing for future challenges and opportunities.

Tips for Smart Budget Management

Developing effective budgeting techniques is essential for anyone looking to navigate personal finance successfully. By understanding and adopting various budgeting strategies, you can gain better control over your money management and work towards your financial goals. Here are some tips to help you manage your budget skillfully:

Tracking Expenses:

Tracking expenses is vital for budgeting, offering clarity on spending and aiding financial decisions. Watching your expenditures helps adjust habits, manage debt, and avoid high-interest loans. Various tools and apps assist in aligning expenses with your budget to ensure you live within your means.

Consider the Envelope Method:

The cash envelopes method is a classic budgeting technique that prioritizes simplicity and discipline in money management. Under this money envelope system, you allocate a set amount of cash to different spending categories, each represented by an envelope.

Once the money in an envelope is spent, you can either refrain from further spending in that category or borrow from another envelope, reinforcing your financial skills in making prudent financial decisions. [3]

While traditional, it offers a tangible way to visualize and control spending, limiting discretionary expenses while ensuring necessary bills are paid. By preventing reliance on credit cards, the method also helps maintain a healthy credit score.

Implementing the 50/30/20 Budget Rule:

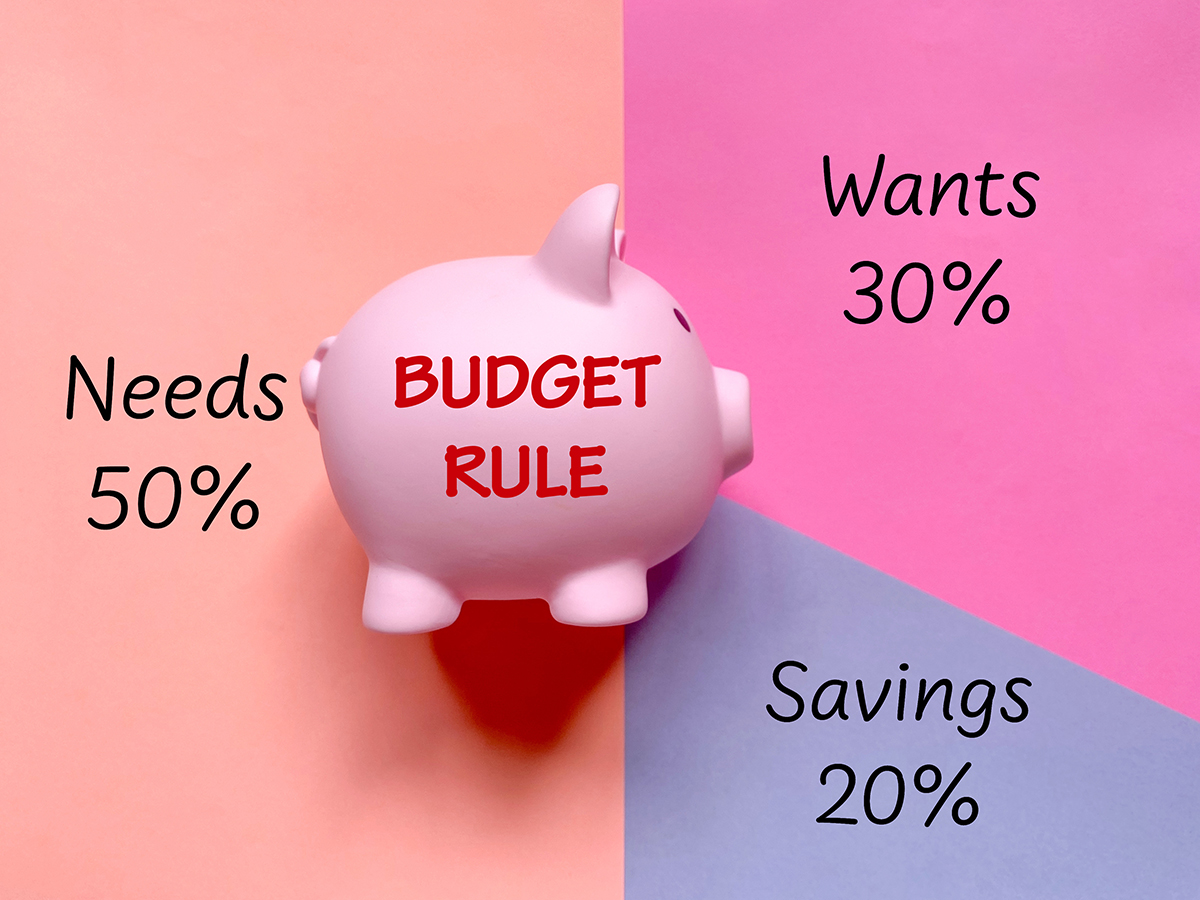

The 50/30/20 rule is a straightforward budgeting method that divides after-tax income into three categories for optimal money management.

In theory, 50% of your income should cover essential living expenses such as housing, groceries, and paying bills. Using this method, 30% should be allocated to discretionary expenses, allowing some flexibility and enjoyment without compromising financial goals. Then, 20% should be directed towards savings and debt repayment.

By adhering to this approach, you can effectively work towards an emergency fund, reduce student loans, or take advantage of compound interest in retirement savings accounts. This rule simplifies financial planning, making it easier to balance immediate needs with long-term objectives.

Making Informed Spending Decisions:

Learning how to budget effectively is an essential skill that can be acquired at any stage of life. It’s never too late to make informed spending decisions, which are fundamental to achieving financial wellness. By understanding where your money goes, you can prioritize financial goals and improve your overall financial literacy.

Recognizing Needs vs. Wants:

One of the foundational aspects of money management is distinguishing between needs and wants. Needs are the expenses vital for survival or basic living, such as food, housing, and healthcare. These are non-negotiable and should typically occupy the majority of your budget according to the 50/30/20 rule.

Wants are non-essential buys like dining out or luxury items, which can hinder financial goals if unchecked. Recognizing these helps improve financial literacy, enabling strategic decisions aligned with priorities. Mastering this distinction offers clarity and control, promoting disciplined money management.

Evaluating Purchases and Expenses:

Evaluating purchases is crucial to financial planning. Track spending and assess how it aligns with your goals. Weigh short-term benefits against long-term implications. Mismanaged credit cards can harm your credit score and increase debt; understanding interest rates aids smart decisions.

Analyzing expenses helps build an emergency fund and manage debt. Regularly review your finances using credit reports and consult professionals if needed. This keeps your financial goals on track and allows adjustments as your financial situation changes.

How Can You Overcome Common Financial Mistakes?

By recognizing errors and making adjustments, you can ensure a healthier financial future.

Here are steps you can take to overcome common financial mistakes:

- Recognize and Acknowledge Financial Mistakes: The first step to overcoming financial blunders is to acknowledge them. Whether it’s overspending, inadequate savings, or poor investment choices, accepting faults is crucial. Conduct an honest review of your finances to identify areas of concern.

- Pay Down High-Interest Debt: If you have outstanding debts, particularly credit card debt, prioritize paying them down. High-interest debts can significantly strain your finances over time.

- Automate Savings and Bill Payments: Set up automatic transfers to savings accounts and automatic bill payments. Automating these processes ensures consistency and helps avoid late fees, boosting your credit score and building savings without requiring constant attention or discipline.

- Invest Wisely and Regularly: Investing can seem intimidating, leading many to delay or avoid it altogether. Instead, start small and educate yourself through online resources or financial advisors. Diversify your portfolio and focus on long-term growth, keeping emotions out of decision-making.

- Seek Professional Advice: If managing finances feels overwhelming or if you’re uncertain about certain decisions, don’t hesitate to seek help. Financial advisors can provide personalized advice, helping you build and execute a strategy that aligns with your unique situation.

- Educate Yourself Continuously: Knowledge is power in the world of finance. Read books, take online courses, and stay updated on financial trends. The more informed you are, the better equipped you’ll be to make sound financial decisions and avoid common pitfalls.

Enhancing Your Financial Security

Enhancing financial security is needful for leading a stress-free life. Mastering personal finance skills can dramatically improve your financial wellness and help you reach your financial goals.

Consider the following steps to enhance financial security:

- Regularly review your credit report.

- Pay bills on time to avoid late fees.

- Understand interest rates and prioritize paying off high-interest debt.

- Educate yourself on compound interest to grow your investments.

- Consult financial professionals for personalized advice.

If filing bankruptcy is your next step as you are learning to manage your finances, contact Ohio bankruptcy lawyer, Richard West for a free consultation today.

Sources:

[1] Financial literacy in the US. (n.d.). weforum.org. https://www.weforum.org/stories/2024/04/financial-literacy-money-education/

[2] Fernando, J. (2025, June 30). Financial literacy: What it is, and why it is so important to teach teens. Investopedia. https://www.investopedia.com/terms/f/financial-literacy.asp

[3] Envelope budgeting | Actual Budget Documentation. (n.d.). https://actualbudget.org/docs/getting-started/envelope-budgeting/