Credit Card Debt Options

— How to escape the nightmare of credit card debt you cannot pay

You’re here because you’re worried, probably frightened, about your credit card debt.

You know you have a serious problem, but you don’t know what to do about it.

You struggle to pay as much as you can, but the balances never seem to go down very much. Sometimes you can’t even make the minimum payments.

It’s sickening. You know you’re going to be slammed with more fees you can’t afford. And every time this happens it destroys any little progress that you made on paying this debt down. It’s one step forward and two steps back. You can’t win.

Even paying the cards creates problems. When you pay as much you can to get the balance down, it leaves you short. So you have to charge on the card again.

It’s a vicious cycle.

You hate it.

You want to stop using the cards altogether – but how can you?

When you get beyond a certain point, credit card debt becomes your worst nightmare.

The endless cycle of struggling to make payments, then having to charge more, – its like being a hamster on a wheel. You’re constantly trying to keep up – but you know – deep in your heart – that you’re fighting a losing battle.

It’s just a matter of time before the whole thing comes falling down on you.

Still, you keep trying. What else can you do?

Sometimes feel angry that you’re paying a fortune in interest to the credit card companies, making them rich at the expense of your family’s needs.

It’s sickening. And it makes you sad too, because you’re trying as hard as you can, doing all you can possibly do, but you know you’re getting nowhere.

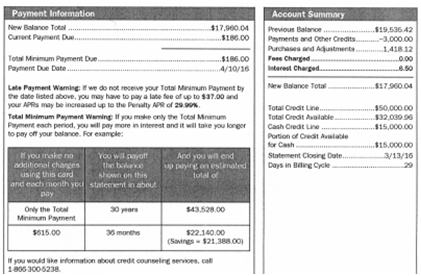

If you’re reading this, you probably feel disgusted and depressed at same time every time you get your bill. I know how you feel, here’s a bill that looks a lot like mine did, years ago.

Mine looked just like this. I owed a ton. I was getting nowhere. It felt hopeless.

Why so high a balance? I had just taken out a big balance transfer at 0% interest. I was unemployed due to a medical catastrophe that I just recently suffered. I was feeding my family on credit. I had no income, no insurance, and there was no hope in sight.

I knew I had to borrow as much as I could, because soon I wouldn’t be able to borrow anything. I felt horrible when I looked at the bottom of the chart to see that in 30 years I would pay much more than double what I actually borrowed. Of course, I had no choice. There was nothing else I could do.

I saw this chart on every single statement that I paid every month, but it was so depressing to me that I couldn’t even look at it after a while. Perhaps you feel the same way.

I was barely able to make the minimums on time and I couldn’t even imagine what it would feel like to have that card paid off. If someone would just take that credit card debt away from me, I imagined, I would swear off credit cards forever. But that never happened. There had to be another way out. But what? I was determined to find it. And I did. And here’s how to find your best way out of credit card debt. Review these options, and compare. Normally, there will be one “stand-out” best approach that will make sense for your situation.

Here are your options, ranked from low debt to high debt

When you’re drowning in credit card debt, there are several options you can use to attack the problem and get yourself out of debt. I’ve been helping people do this for over 30 years now, so I can tell you the best way to find the right solution for your needs.

Credit counseling (If you’re not too far behind)

When you’re not too far behind, credit counseling may be your answer. If you feel that you would be able to dig yourself out of the whole you’re in now if you simply managed your money better, then explore credit counseling.

Credit counselors may be able to help you:

- better understand your spending habits,

- identify ways to cut back on needless spending

- help you with your budget (or create one if you don’t have one)

- show you how to set, and achieve, your goals.

To use a medical analogy, if you’re not sick, but you have a few “unhealthy” habits that you need to address before they get out of hand and really start causing trouble, you could go to a doctor and get a “wellness checkup.”

Perhaps the doctor will tell you to go on a diet, or maybe just start eating better, maybe get a trainer, start exercising. This may be all you need.

Catch it early, and more drastic measures would not be needed.

Credit counseling is a lot like this – like going to the doctor before you get sick.

But, let’s be honest about this. Who does this? A few might, but not many.

Credit card debt, and your finances in general, are really no different.

If you catch it early, debt disaster is easier to control or avoid. But if you’re reading this, then you probably need more powerful help than just a course in credit counseling would give you. The next option to consider would be a debt management plan.

Debt management plans

Debt management plans are, according to all of the advertising you see on television and on the Internet, the answer to everybody’s debt problems.

There are so many different debt management programs available that is actually bewildering.

They sound wonderful.

An easy answer to your debt difficulties.

Just hand all your bills over to them and they’ll do the work, contact your creditors, negotiate wonderful settlements, save you a ton of money, and that your life will be all good again.

Not hardly.

That’s just they way they get you in the door.

These debt management programs do work, sometimes, but are often dangerous because they often fail. There are no guarantees, and they don’t always make the dangers clear to you.

In fact, a DMP can’t guarantee that they will be able to negotiate anything better than you could do yourself if you tried. And they often fail to warn you about all the nasty things that will happen when things don’t go according to the rosy promises that they give you.

Debt management programs are supposed to inform you that:

- they can’t guarantee results,

- you’ll be taxed on any debt that is forgiven,

- creditors can refuse to work with you and sue you instead.

- when you do get sued, they can’t help you one single bit.

When you get sued as a result of a failed attempt by the debt management program to negotiate a settlement for you, you’re either left to your own resources to deal with the lawsuit, or sometimes they’ll refer you to one of their network attorneys.

Network attorneys often are attorneys who agree to accept substandard pay for these cases and sometimes deliver substandard results. (Think about that one for a second – what kind of attorneys are taking these cases? And, what do you think they are going to do for you?)

What one hand gives, the other takes away… and your credit demolished.

When you consider the fact that you’ll be taxed on any gains you make in a debt management program, and add in the fees that the debt management program will charge you, you can see that the savings that you actually realize will be a lot less than you probably were promised.

And, in order to qualify for the best results, they will tell you, they have to make sure that you are at least 2 to 3 months behind in your payments, and this will ruin your credit. It’s part of the cost of doing business with a debt management program.

With all of the problems associated with debt management programs, you might think that it would be difficult for them to stay in business.

Think again.

They are flourishing all over the internet! Why? How?

They use your subconscious mind and hidden emotions against you!

Debt management programs prey on your emotions. They feed on the public’s general ignorance, and fear of the dreaded “bankruptcy” label. The “stigma” still associated with bankruptcy fuels the coffers of the debt settlement industry.

This industry is not well regulated. In fact, they are regularly the subject of governmental actions against them. The get fined and even put out of business, but they keep re-appearing. Springing up like weeds on the internet. Ready to take advantage of the next debt burdened person who they can talk into the partial solution and often empty promises they sell.

Debt management programs satisfy the emotional desire some people have to avoid bankruptcy. Some folks would rather do anything than even think about what a bankruptcy could do for them.

Even a poor solution in a debt management program to these frightened folks, would be far more preferable than a much better result obtained through bankruptcy.

It is exactly this emotional fear that keeps some debt management companies in business, and keeps some consumers from ever getting out of debt.

But, don’t get me wrong, there are some situations where the DMP is a good choice.

Debt management programs do have a place in the world.

If you’re the kind of person who is uncomfortable negotiating with your creditors, and you don’t really have a lot of debt – in other words, the relief that you actually need is not great compared to your income and ability to pay, then a debt management program may actually be a good way for you to obtain the kind of results that you probably could get yourself if you wanted to put the time and effort into it.

Most people don’t enjoy haggling with creditors or negotiating settlements. Admittedly, its no fun. People pay me a lot of money to do it, and I do a great job. But, it’s an uncomfortable position to be in, because to get the best results in a debt management program setting, you do have to be behind about three months.

Trashing your credit score is part of the debt management program – it is a requirement in order to get the best results. Unfortunately, the damage caused to your credit is a lot worse, and takes longer to correct, than if you would have just discharged the debt in a bankruptcy and started over rebuilding your credit with a proven program like the one I have developed.

If you’re willing to make the trade off, accept the difficulty that you’re going to have with trashed credit, and you have the kind of situation where a partial solution is acceptable, then a debt management program does make sense.

Also, if you have an emotional aversion to even considering what a bankruptcy could do for you that is so significant that you won’t consider bankruptcy under any circumstances, then a debt management program may be the only option that you can pursue.

Debt settlement – if you dare . . .

You might know about a dangerous game that teenagers in years past used to engage in with their automobiles called “chicken.” In a game of chicken, reckless teenagers would drive their automobiles towards each other at high rates of speed, the object of the game to be the last person to veer out of the way, and thus not be a “chicken.”

Debt settlement is a lot like a game of chicken.

I am a certified and seasoned debt arbitrator. I conduct these games of chicken between my clients and the creditors. It is a nerve-racking experience for the client. In about half of the cases, the creditor doesn’t blink, and instead turns the debt over to a law firm and my client get sued. They’re not chicken. They file the lawsuit.

Fortunately, unlike in a real game of chicken, I am an attorney and I can defend the lawsuit and negotiate a settlement with the attorneys.

My client doesn’t crash and burn. Nevertheless, debt settlement is a dangerous game.

Debt settlement works. I’ve done many of them.

In some cases, I will recommend debt settlement as the best way to deal with certain kinds of debt, for certain kinds of clients.

Debt settlement works where my clients have assets they can’t protect in a bankruptcy. Or, their income is such that they would end up paying more in a bankruptcy than I believe I could negotiate outside of bankruptcy.

And, there are some folks who come to see me who would be great candidates for bankruptcy, but because of transactions that they’ve entered into, particularly family transactions, if they filed a bankruptcy their family members would be sued by the bankruptcy trustee, which nobody wants to see happen.

I once had a case where I represented an actual honest-to-goodness rocket scientist. He actually had enough money saved up to pay off his debt but thought there would be a better way to approach it. He was a very smart guy. He was right.

He came to see me and I explained how debt settlement program would probably allow him to pay a lot less than he would have to pay in a bankruptcy but he would likely be sued in the process and we would have to deal with that if it happened.

He was a pretty smart guy and he took a few weeks to think it over. Here’s what he told me when he came back.

“Mr. West, I thought about what you told me and I understand that I could probably save money if I went with a debt settlement option but I’m going to ask you to file a Chapter 13 bankruptcy for me instead. I don’t want to have to endure the prospect of being sued for the next several years. I’m nearing retirement and honestly I would rather focus on other things than potential litigation as I try to deal with my debt. I know that a chapter 13 will cost me a little more but the certainty of the outcome, the 100% guarantee that I will be debt free in five years and I will still save tens of thousands of dollars in interest in the process. That’s enough for me and I think it’s better to use bankruptcy than debt settlement,” he explained.

Smart guy.

In other situations, I’ve had the opposite result. Some folks are willing to accept that lawsuits will likely be part of the process. I have another client who really didn’t have any choice, she had to go the debt settlement route. I’ve saved her about $15,000 over what she would’ve paid in a chapter 13, settled five accounts for much less than was owed but also had to defend her in two different lawsuits.

Nevertheless, she is very happy with the results. She understood what she was up against, and was “ok” with being sued. She’s money ahead and that’s enough for her.

Smart gal.

Bankruptcy – it’s probably not what you think.

You might know about a dangerous game that teenagers in years past used to engage in with their automobiles called “chicken.” In a game of chicken, reckless teenagers would drive their automobiles towards each other at high rates of speed, the object of the game to be the last person to veer out of the way, and thus not be a “chicken.”

Debt settlement is a lot like a game of chicken.

I am a certified and seasoned debt arbitrator. I conduct these games of chicken between my clients and the creditors. It is a nerve-racking experience for the client. In about half of the cases, the creditor doesn’t blink, and instead turns the debt over to a law firm and my client get sued. They’re not chicken. They file the lawsuit.

Fortunately, unlike in a real game of chicken, I am an attorney and I can defend the lawsuit and negotiate a settlement with the attorneys.

My client doesn’t crash and burn. Nevertheless, debt settlement is a dangerous game.

Debt settlement works. I’ve done many of them.

In some cases, I will recommend debt settlement as the best way to deal with certain kinds of debt, for certain kinds of clients.

Debt settlement works where my clients have assets they can’t protect in a bankruptcy. Or, their income is such that they would end up paying more in a bankruptcy than I believe I could negotiate outside of bankruptcy.

And, there are some folks who come to see me who would be great candidates for bankruptcy, but because of transactions that they’ve entered into, particularly family transactions, if they filed a bankruptcy their family members would be sued by the bankruptcy trustee, which nobody wants to see happen.

I once had a case where I represented an actual honest-to-goodness rocket scientist. He actually had enough money saved up to pay off his debt but thought there would be a better way to approach it. He was a very smart guy. He was right.

He came to see me and I explained how debt settlement program would probably allow him to pay a lot less than he would have to pay in a bankruptcy but he would likely be sued in the process and we would have to deal with that if it happened.

He was a pretty smart guy and he took a few weeks to think it over. Here’s what he told me when he came back.

“Mr. West, I thought about what you told me and I understand that I could probably save money if I went with a debt settlement option but I’m going to ask you to file a Chapter 13 bankruptcy for me instead. I don’t want to have to endure the prospect of being sued for the next several years. I’m nearing retirement and honestly I would rather focus on other things than potential litigation as I try to deal with my debt. I know that a chapter 13 will cost me a little more but the certainty of the outcome, the 100% guarantee that I will be debt free in five years and I will still save tens of thousands of dollars in interest in the process. That’s enough for me and I think it’s better to use bankruptcy than debt settlement,” he explained.

Smart guy.

In other situations, I’ve had the opposite result. Some folks are willing to accept that lawsuits will likely be part of the process. I have another client who really didn’t have any choice, she had to go the debt settlement route. I’ve saved her about $15,000 over what she would’ve paid in a chapter 13, settled five accounts for much less than was owed but also had to defend her in two different lawsuits.

Nevertheless, she is very happy with the results. She understood what she was up against, and was “ok” with being sued. She’s money ahead and that’s enough for her.

Smart gal.

Bankruptcy is not a “Last Resort” (or, it shouldn’t be)

You will read and hear it said that bankruptcy should be a “last resort.”

Really? Why? Think about that for a second…

Why does everyone seem to accept as true the proposition that “You should try everything else in your power first and only after you have tried all options, (and failed at all of them!) should you even consider the possibility of filing bankruptcy.

If it’s clear that other options won’t work, why bother wasting your time (and money) on them? Let’s use some common sense here, shall we?

Imagine you are sick and you go to the doctor. Your illness is serious, and there are different forms of treatment available. Wouldn’t you want to consider all of them, all at the same time, all up front, before making any decision about which to try?

Wouldn’t it be a better idea to honestly and impartially analyze all of the different treatment options, consider the risks and rewards and benefits of all, and make the decision that makes the most sense for you?

And, if an extreme treatment, like surgery, is the best bet, you should choose that option first, don’t you agree?

And that’s why I think bankruptcy should not be a last resort.

It shouldn’t be a first resort either.

It should be evaluated at the same time and with the same approach that you are evaluating all of your options for debt relief.

Bankruptcy, like surgery, is a powerful option and should not be the “weapon of choice” for all battles. But if you honestly and accurately assess your situation – it should be pretty apparent to you whether or not filing a bankruptcy, like opting for surgery, makes any sense for you.

The truth is that bankruptcy might be the best option. It might keep you from wasting time and money on other options.

Your priority is clear – to find out what’s best, and most effective, for your financial recovery, and the faster the better.

The “Real Reason” many people will NEVER find the right solution

I’ve found, after 30 years of practice, that the real reason that most people won’t ever discover the best solution to their problems, especially if it’s a bankruptcy, is – in a word – pride. Or, what passes for pride, but really isn’t.

There are two kinds of pride, a good kind and a false kind that is not really pride at all.

Good:

There is pride in a job well done, pride and satisfaction that you get in doing the right thing. But there’s also a different kind of pride which really isn’t pride at all.

Bad:

The bad kind or false kind of pride is really ego in disguise. I know this all too well because it happened to me.

Many years ago when, due to a broken back, I was unable to work and had no income, I had to live on borrowed money. I felt like a failure. I felt that everybody was looking down on me and I hated the fact that I had to borrow money to feed my family and pay my house payment.

I wanted desperately to regain the self-confidence and self-esteem that I had before my tragic accident. I felt that the charity that people were giving me, and the loans that I was taking were just more evidence that I’d failed as a human being, failed as a husband, failed as a provider to my family. I felt ashamed. I was miserable.

I can see now, later, that this was just my ego in disguise. My self-esteem had been shattered. It wasn’t until later that I discovered that all of my friends and family who were helping and supporting me really didn’t look down on me, they were supporting me because they believed in me. I was the only one that didn’t believe in me.

So now, when I counsel people about bankruptcy options, and I can sense that they’re reluctant to give the bankruptcy option a full and fair consideration, I ask them to imagine a friend or family member who was in deep financial problem trouble, so deep that they might have to consider bankruptcy as an option.

I asked my client this question, “Wouldn’t you, without any hesitation, support and encourage your friend or sibling to go seek out all the options that are available to help them? Wouldn’t you encourage them to do this?”

Invariably they say, “Yes of course I would I would even drive them to the office to see you!”

I reply, “I knew you would! So, why can’t you look in the mirror and treat yourself with the same kind of compassion, understanding and support that you would – without hesitation – give to your friend or family member?”

Nobody ever has an answer to this question.

Because, of course, there is no answer.

We’re just wired that way. We use a kind of “double-standard” on ourselves. What’s “OK” for someone else is not “OK” for us. But why should this be so?

Example: here’s a true story that illustrates the point very well.

I once had a couple come to see me because they were being sued. The husband had been a very prominent figure in his community. He held a high elected office in law enforcement. They were pillars of the community, well known and respected.

But, because of some business dealings, the husband had been sued for a large sum of money. To make matters worse, his oldest son had cosigned on this loan and was being sued as well. Despite the understandable reluctance and embarrassment, and yes, pride, the parents came to see me to find a solution to their difficulty.

They needed the best solution.

They were ready to accept whatever that might be.

I brought my 30 years of expertise to bear on their problem.

I analyzed all possible options.

We discussed all options, compared them all.

Although there were several possibilities, clearly the best one was to file bankruptcy. In this bankruptcy, a small portion of the judgment would be paid but the majority of this debt would be discharged without payment. (but, it would fall on the co-signer son)

And, they would be able to keep everything that they had worked all their lives to get, their home, their cars, their farm equipment etc. Although this was not what they were hoping for, they both understood that it was the best solution to their problem. We filed a chapter 13 for them, which has now been successfully concluded, and they are debt-free. We wiped out all the debt, and saved all of their property.

It was a solution that really worked.

It was the right solution. It was the best one for their circumstances, although emotionally, it was very difficult for them. I’m proud of them both.

The son, on the other hand, took a different route.

Although he came to see me too, and I carefully analyzed his situation and determined that, like his parents, his best solution was to file bankruptcy.

But, sadly, he couldn’t bring himself to do it.

I’m sure he has his reasons, but I suspect that, unlike his parents, he was unable to overcome his emotional barriers. He couldn’t bring himself to file bankruptcy. And, although his parents are now free of this burden, he is, I am told, suffering a wage garnishment and probably other collection efforts as well. I am very sorry when this happens.

Chapter 7 bankruptcy

Many people think, because of what they’ve heard and information that they read on the Internet, that chapter 7 is a “liquidation bankruptcy” where, you will find this ominous proclamation:

all of your nonexempt property is taken from you and sold for the benefit of creditors.

In practice, most folks keep all their property. They don’t lose a thing.

Although it’s true that nonexempt assets can be sold for the benefit of creditors, Ohio has exemption laws protect just about everything that you own.

There isn’t anything left, after application of the exemption laws, to sell for the benefit of creditors, so most people keep their homes and cars, continue to pay for them, and discharge all of their unsecured debt with no payment whatsoever.

Chapter 7 is commonly a good approach for folks who:

- Have suffered significant medical issues,

- Have been through a divorce

- Suffered a medical issue

- Suffered a loss of job

Or, sometimes the amount of credit card debt that you have just keeps mounting and mounting to the point that, even though you want to pay, it just doesn’t make any sense to continue to try to pay an enormous debt that will take you 25 to 30 years at minimum payments to pay off (assuming you never make any more charges on it)

If your debt has grown to these proportions, then the best non-bankruptcy program in the world is not going to be an effective way to approach your problem.

Of course, there are limitations on eligibility to file a Chapter 7. It has to be the most sensible thing for you to do, and it’s only available if you truly don’t have any money left over after you pay for your normal living expenses, housing, food, clothing, transportation etc., to pay any of your other debts. If you can pay a meaningful amount to your unsecured creditors, then you probably should do so. When this is the case, you’ll probably be looking at a chapter 13.

Chapter 13 bankruptcy

Chapter 13 is a payment plan but, beyond that, it is difficult to generalize.

Most of my Chapter 13 payment plans don’t pay anything to the unsecured creditors.

Its about like a chapter 7, actually.

Chapter 13 is based, in part, on your ability to pay. And, sometimes, after we pay for our house, cars, and living expenses, there isn’t much left over.

Chapter 13 is a great tool to use if you’re behind in your house payments. And, using Chapter 13, we are often able to strip off second mortgages and pay less for our cars than owe on them or would have to pay in a chapter 7 if we reaffirmed the car debt.

Chapter 13 bankruptcy is an extremely powerful and flexible tool. And, when combined with other options – including aftercare to help you restore your credit – chapter 13 is often the most effective tools that you can use to deal with debt and quickly rebuild credit.

Many people think the chapter 13 requires you pay back all of your debts. In southern Ohio, nothing could be further from the truth. The number of chapter 13 cases that I see that actually do pay back all of the debts is a very small number of the cases filed.

More often than not, creditors are paid only ten cents on the dollar – or less. But, the benefits to filing chapter 13 can often be greater than if you file a Chapter 7 (even if you do qualify to file a Chapter 7).

Chapter 13 you may be able to:

- strip off second or third mortgages

- pay back only 1% on your credit cards and medical debt

- cram-down the amount you owe on your cars and save you thousands of dollars

- lower the interest rate on cars that can’t be crammed down

- stop foreclosure and give you up to five years to catch up on your missed house payments

- allow you to get rid of rental properties that you can’t sell because they’re upside down

- replace automobiles prior to filing bankruptcy so that you can surrender the upside down car that you have

- stop student loan collections for up to five years, even though they don’t get discharged, you can be collected from while in a chapter 13 bankruptcy

Summary: How to find the best solution to your credit card debts

See a credit counselor.

Contact your creditors yourself and try to negotiate deals.

Consider a debt management plan.

Contact a debt arbitration specialist for debt settlement.

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Step Two. Eliminate the options that are not realistic for you.

Step Three. Contact a seasoned, certified specialist with years of experience to help you compare the pros and cons of the options that might work for you. Don’t forget that you will need to rebuild your credit afterwards, and clean up your credit report too. (very important – debt elimination without credit restoration is a recipe for future failure)

Step Four. Once you have help comparing the pros and cons of all the different options, you will know which one will work best for you. Have the certified counselor give you a step by step plan to put this “best solution” into action and help you successfully complete it.

Step Five. Get the counselor to assist you in the credit rebuild and credit report correction process. You want a certified credit counselor who will teach you what you need to look out for in the future to keep your credit in tip-top shape.

This process will help you cut through all the confusion and zero in on the best solution for your situation. This is a common-sense, practical approach that I have used for almost 30 years to help my clients get a true and lasting financial recovery.

Filing bankruptcy is only one option. Chapter 7 bankruptcy and chapter 13 bankruptcy are powerful tools, and for many, filing bankruptcy IS the best debt relief option.

The problem with going to a bankruptcy attorney who is not also a certified credit counselor is that you may not get a full and complete comparison of the pros and cons of the non-bankruptcy options. I find non-bankruptcy options work better than filing bankruptcy for a number of those whom I counsel.

Even if filing bankruptcy is the best solution, filing bankruptcy, without more… without proper follow-up from a certified credit counselor to help rebuild credit and clean up errors on your credit report is not enough. Without this important follow-up, your fresh start could be a false start.

You really need a credit counselor to help finish what the bankruptcy starts, so that you end up with a full financial recovery, with good credit and a strong credit score. Not just a bankruptcy discharge.

Conclusion: When you are faced with credit card debt that is more than you can handle, you need to consider all your options, weigh the pros and cons of each option, seek professional guidance to implement the best strategy, and then use a proven program to rebuild your credit and keep your score as high as possible so you can use credit wisely in the future.

Our Legal Services

Bankruptcy Learning Center

- Bankruptcy Can End a License Suspension

- Bankruptcy Individual vs Joint

- Can the Self Employed File Bankruptcy?

- Chapter 7 vs Chapter 13

- Cash Advance and Bankruptcy

- Debt Consolidation vs Bankruptcy

- Divorce and Bankruptcy

- Divorce and Chapter 7

- Divorce and Chapter 13

- Divorce Chapter 7 vs Chapter 13

- How to Keep Your Car

- How to Keep Your Pets in Bankruptcy

- How to Keep Your Property

- How You Can Loose Your Retirement

- Is Chapter 7 or Chapter 13 Better?

- Judgment Proof vs Bankruptcy

- Liens in Bankruptcy

- Military Bankruptcy

- Payday Loans and Bankruptcy

- Life After Bankruptcy

- Chapter 13 vs Loan Modification

- Short Sale vs Bankruptcy

- Small Business Bankruptcy

- Stop Lawsuits with Bankruptcy

- What is an Automatic Stay?

- What is a Bankruptcy Exemption?

- What To Do if You Lost Your Job

- What Does the Bankruptcy Trustee Do?

- Tax Debt and Bankruptcy

- The Downside of Filing Bankruptcy

- The Pros & Cons of Filing Bankruptcy

- The Truth About Bankruptcy

Useful Calculators

Here are two helpful calculators for managing your debt repayments and Chapter 13 commitments.